Long Term Care (LTC) organizations provide both medical and non-medical services to assist in meeting the needs of people whose self-care is limited. Workers provide both medical and non-medical care, and are subject to strict regulation. This results in the need for labor management that is both specific and accurate, keeping in compliance with federal, state, and local labor laws.

LTC organizations have several labor management challenges and priorities relating to these four primary personas, which are addressed by using TMS Attendance, helping ensure compliance, simplify budget management and generate an optimized composition of staff.

Ensure Compliance

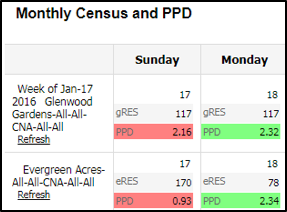

Compliance is king. It is critically important for LTC organizations to monitor census and ensure proper staffing and care ratios. Most organizations still use spreadsheets to manage shift coverages, which can be extremely time consuming, cause inaccurate data, and lead to low CMS ratings.

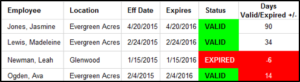

Additionally, keeping a keen eye on employee certifications can be tedious, and if they are not properly monitored, can lead to penalties and put a halt to an employee’s ability to legally work.

- We provide a Monthly Census & PPD report that can automatically track coverage ratios and easily visualize where coverage ratios are below thresholds to highlight where attention is needed.

- Our system incorporates easy monitoring of employee certifications and visual cues to indicate employees who are approaching expiration to ensure action is taken.

Budget Management

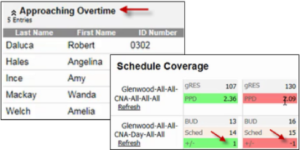

Long-term care organizations rely on funding from Medicaid and Medicare, making it vital for a facility to remain on budget while simultaneously maintaining coverage requirements against census data. Capturing and reporting on direct care, non-direct care, and nursing staff hours can be a chore, and countless hours can be spent organizing shift totals to try and identify where changes are needed to help stay aligned with changing Census numbers. Additionally, shift changes and last-minute coverages can lead to increased overtime expenses if weekly hours aren’t closely watched. This can quickly drain your facility’s budget.

- TMS Attendance allows users to not only gain quick insight into direct and non-direct care hours, but users can also drill down into specific shifts, easily sort data and export the information to send to owners as needed.

- We can help save time managing your budget by providing easy access to view where gaps or surpluses to coverages exist. Intelligent decisions can then be made to reduce or add staff accordingly, and upon the need to add staff – avoiding scheduling employees who are approaching overtime.

Staff Management

Managing staff and attendance within LTC organizations has become increasingly challenging as the industry faces growing rates in absenteeism. For example, it is not uncommon to see absenteeism rates of nine to 10 percent for Certified Nursing Assistants (CNAs). Legal and professional standards now say that those absent employees must be replaced to maintain the desired standard of care. This leads to coverage issues, directly impacting CMS | PBJ reports and ultimately a facility’s CMS rating. The time needed to keep up with reporting, varying shift premiums, and callbacks is a burden.

- If you have minimum coverage requirements and find yourself understaffed due to an absence, our schedule coverage, along with Seeker for absence management, helps ensure coverage levels are properly achieved and compliance is maintained!

- Seeker can automatically generate pre-defined substitution lists that are FILTERED to remove unqualified employees and match only the replacements with the required skills for the available shift.

- Eliminate the worry associated with generating and submitting PBJ & CMS 671/672 reports. Our solution provides this data with the click of a mouse, no need to manually calculate, simply download the file(s) and upload to the CMS website.

Learn more about how TMS Attendance Enterprise can help your facility. Contact Monica at Time Management Systems by calling (605) 306-5529.